All Categories

Featured

Table of Contents

- – Senior Benefits Insurance Services Santa Ana, CA

- – Harmony SoCal Insurance Services

- – Senior Insurance Quotes Santa Ana, CA

- – Best Eye Insurance For Seniors Santa Ana, CA

- – Health Insurance Seniors Santa Ana, CA

- – Senior Insurance Advisor Santa Ana, CA

- – Affordable Medical Insurance For Seniors San...

- – Harmony SoCal Insurance Services

Senior Benefits Insurance Services Santa Ana, CA

Harmony SoCal Insurance Services

2135 N Pami Circle Orange, CA 92867(714) 922-0043

https://maps.google.com/maps?ll=33.823884,-117.830838&z=16&t=h&hl=en&gl=US&mapclient=embed&cid=276141583131225364

It is essential to review your alternatives right now to make certain you continue to have the Medicare wellness and medication coverage you want. Some types of Medicare health insurance aren't Medicare Advantage Plans, however are still component of Medicare. The coverage they provide differs depending upon the details kind of strategy.

Medicaid likewise covers added solutions beyond those provided under Medicare, including nursing facility treatment beyond the 100-day limit or proficient nursing facility treatment that Medicare covers, prescription drugs, glasses, and hearing aids. Solutions covered by both programs are initial paid by Medicare with Medicaid completing the difference approximately the state's settlement limit.

* Features readily available differ by plan. *Please note, MVP is needed by law to send out some plan papers by postal mail. +MVP virtual treatment services through Gia are available at no cost-share for many members. In-person sees and recommendations go through cost-share per strategy. Exceptions exist for self-funded strategies. Gia telemedicine solutions will be $0 after the deductible is fulfilled on MVP QHDHPs starting January 1, 2025, upon plan renewal unless the Affordable Care Act 2023 QHDHP/HSA risk-free harbor is additionally extended.

Wellness benefit strategies are released by MVP Wellness Plan, Inc., an operating subsidiary of MVP Health and wellness Care, Inc. Every year, Medicare assesses strategies based on a 5-star rating system.

Senior Insurance Quotes Santa Ana, CA

Listen to this web page. Medicare Part D Plans Near Me Santa Ana. Your web browser does not sustain the sound aspect. If you are a PSERS retiree, survivor annuitant, or the partner or dependent youngster of a PSERS retired person or survivor annuitant, and you are eligible for Medicare, you can enlist in: Medicare Supplement plan: HOP Medical Strategy Worth Medical Strategy Medicare Advantage plan (Highmark, Aetna, Independent Blue Cross, Resources Blue Cross, or UPMC) If you maintain Initial Medicare, you can supplement it by signing up in a Medicare Supplement strategy

Insurance coverage while traveling abroad is limited to services covered by Medicare. Note: If you exhaust your Medicare advantages, this plan does not offer extra coverage.

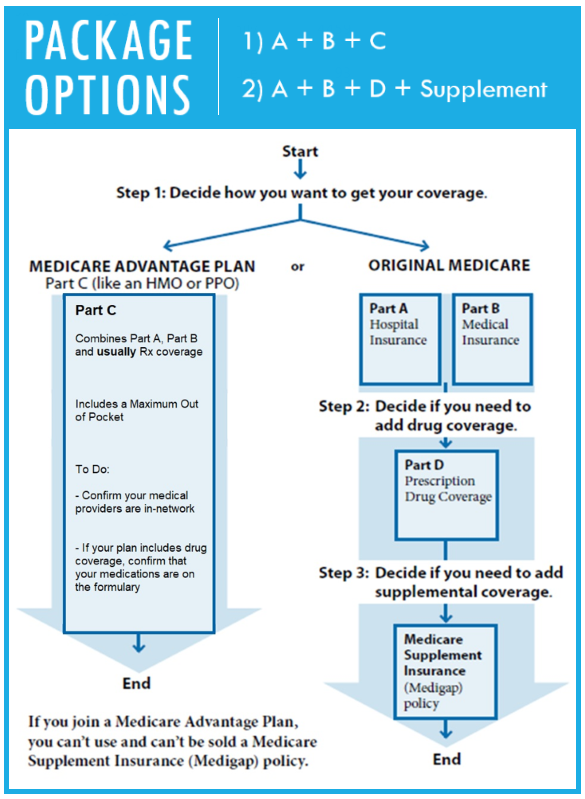

You can choose a Medicare Advantage plan instead of Original Medicare and a Medicare Supplement plan. Highlights: Strategy integrates medical and prescription medicine advantages in a single program. If you select this option, you can not enlist in any type of other Medicare prescription medication plan. Insurance coverage business have contracted with the federal government to supply Medicare advantages.

Each strategy offers only specific locations, so the plans readily available to you rely on where you live. You should make use of an in-network carrier to obtain the optimum benefit. See the local Medicare Advantage plan guides for descriptions of the Medicare Advantage plans readily available where you live, the benefits they offer, and their prices.

Best Eye Insurance For Seniors Santa Ana, CA

state and government lawsMedicare's nationwide coverage decisionscoverage decisions made by companies in each state that process Medicare assertsMedicare Component A covers hospitalization costs. This includes inpatient care in the medical facility, knowledgeable nursing center, hospice, and home health care. It does not consist of custodial or long-term care.Medicare Component Bcovers clinically essential and some preventive services. Individuals are liable for paying a regular monthly premium for Component B solutions. In 2025, the standard Component B premium is $185. This quantity may boost depending on an individual's earnings. Preventive solutions include procedures to prevent disease, such as the influenza shot or tests that detect a condition at an onset, when treatment is most reliable. Part A does not normally cover medicines, medical devices, or tools that.

somebody needs to take home. Part B does not cover items such as: dentures and many oral careeye tests connecting to obtaining a prescription for glasseshearing help acupuncture, unless it is particularly for chronic reduced back painroutine foot careMedicare Advantage(Part C)is an alternateto Initial Medicare(parts A and B). Private medical insurance business offer several Medicare-contractedwellnessplans that offer all Component A and Component B advantages, however with some added options.Medicare Advantage may have lower out-of-pocket costs than Original Medicare. Insurance providers typically have actually phoned number tiers, with commonly recommended, reduced cost drugs in the lower tiers and much less typical, extra costly medications in greater tiers. Each tier will generally have its very own copayment quantity, with greater rates having higher out-of-pocket costs. A person's overall costs will depend on a number of factors, consisting of which drugs they take and whether or not they make use of a pharmacy within the strategy's network. There is no one-size-fits-all choice when it comes to choosing the very best Medicare strategy, as individuals have various situations, needs, and concerns. Other factors to consider play a function, the decision might come.

down to weighing the flexibility benefits versatility Original Medicare against the versus benefits of Advantages Advantage plansBenefit After meticulously examining the benefits and downsides, a person can enroll in the strategy that is ideal for them. Since September 2024, there were 2,951,112 Pennsylvania residents enlisted in Medicare. That's 20 %of the state's population, versus about 18%of all U.S. residents enlisted in Medicare. Pennsylvania has the fifth-highest percent of locals that are age 65 or older, so it makes sense that the state has a higher-than-average percentage of locals enrolled in Medicare. Medicare eligibility is likewise triggered when an individual has been getting impairment advantages for at least two years (people with ALS or end-stage renal condition do not have to wait 2 years for their Medicare enrollment to start). As of late 2024, almost 11%

of Pennsylvania's Medicare beneficiaries were under 65 and eligible for Medicare because of a disability(instead of being eligible due to their age ). There are pros and cons to either option, and the"right"solution is different for each person. Volunteer therapists, trained in areas of health insurance policy coverage and benefits that impact Medicare beneficiaries, offer details and assistance for managing cases and in reviewing medical insurance alternatives. Volunteer counselors do not supply legal suggestions, sell, recommend, recommend any certain insurance policy product, agent, insurance firm or strategy. They provide info and aid to ensure that you can make your very own choices. SHIP counseling consultations are now being held essentially, over the phone or with the help of other innovation or face to face. To set up your visit, contact the lead in your area, or call your County Workplace on Aging. NJ Save is an online application to help low-income senior citizens and people with disabilities save money on Medicare costs, prescriptions prices, and various other living expenditures. SHIP creates and routinely updates graphes outlining the numerous Medigap, Medicare Advantage and Component D medicine plans supplied in New Jacket. These graphes have been uploaded below to assist you compare plans and make an educated choice regarding which plan best fits your needs and spending plan. Please note, nevertheless, that because Medigap alternatives and prices can change at anytime throughout the year, it is suggested you call the firm you want to validate the information/premiums offered on these graphes prior to signing up or making an insurance coverage adjustment. Ask the company you are interested in selecting how this advantage functions. SHIP provides cost-free help to New Jacket Medicare beneficiaries that have issues with, or concerns regarding their health and wellness insurance. have actually been established in all 21 counties to offer you. You can additionally contact a SHIP counselor via your. For many elders and senior citizens, the most effective medical insurance plan will be with Medicare. Medicare can be confusing because it has numerous various components, however ValuePenguin can help you browse it. For numerous seniors, a wonderful option is Original Medicare (Parts A and B)with Medicare Supplement Strategy G from AARP/UnitedHealthcare (UHC)if you do not mind paying more per month for more versatility when it comes to picking your physician. Finest general: MedicareBest overall: Medicare

Health Insurance Seniors Santa Ana, CA

Best for packed coverage: Medicare AdvantageBest for bundled protection: Medicare Advantage Best if you have a reduced income: MedicaidBest if you have a reduced earnings: Medicaid Medicare is the most effective medical insurance alternative for seniors and retired people. Medicare is the most inexpensive medical insurance with the most effective advantages for people. Initial Medicare consists of Component A(hospital insurance policy) and Component B( clinical insurance policy ). With Original Medicare, you can get care from 99%of the physicians in the country. On top of Original Medicare, you can include extra insurance coverage from private wellness insurance policy companies with a Medicare Supplement plan( additionally called Medigap ). Another add-on is a Medicare Part D strategy for prescription medication protection, which is your only way to obtain prescription drug insurance with Initial Medicare.(additionally called Medicare Part C)is a medical insurance plan that you buy from an exclusive insurer. Strategies have to cover the exact same solutions as Initial Medicare, and they normally consist of prescription drugs, oral and vision. AARP/UnitedHealthcare has the ideal Medicare Benefit strategies for 2025 as a result of its small cost, excellent insurance coverage and high degrees of client contentment. AARP/UnitedHealthcare has the best combination of cost, protection and high quality. The company additionally markets plans across the country, except in Alaska. This general strong efficiency makes it the ideal Medicare Advantage business. This means you're just in charge of paying$ 185 each month for Medicare Part B. AARP/UnitedHealthcare's Medicare Benefit plans have excellent scores on, with an average of 3.6 out of 5 celebrities. That places it among the very best business that market strategies across the country. AARP/UnitedHealthcare markets Medicare Advantage plans in every state however Alaska. AARP/UnitedHealthcare is the finest firm for Medigap plans in 2025. For the majority of people, the finest business for Medigap insurance coverage is AARP/UnitedHealthcare. Medicare Part D Plans Near Me Santa Ana. Medicare Supplement(Medigap)prepares cover a number of the prices that you usually pay if you have regular Medicare. The coverage you obtain

with an offered plan letter coincides no matter which firm you pick. Medigap prepares generally set you back more than Medicare Advantage. You'll usually pay less when you obtain clinical treatment with a Medigap plan than with a Medicare Benefit plan. This is particularly helpful for elders who are worried regarding clinical expenses increasing as they age. With Medigap, you can most likely to any type of medical professional that approves Medicare. Plan G doesn't cover the yearly Medicare Component B insurance deductible, which is just$257. This means you'll need to spend for some clinical care at the start of the policy year before your costs reaches that amount. Along with the standardized protection for clinical and hospital care, AARP/UnitedHealthcare strategies stick out for the wide option of extra add-on coverage. There are some exemptions to this policy. AARP/UnitedHealthcare offers Medigap Select Plan G, which just has insurance coverage for in-network medical professionals. Choosing this choice can give you the exact same coverage as a conventional Plan G however at a less costly rate. UnitedHealthcare obtains roughly 40 %fewer issues than a typical firm its size. Wellcare is the very best Medicare Component D company because it uses high-quality, affordable protection. The business has low typical regular monthly prices, and some plans cost as little as $0 each month. If you choose Initial Medicare, the only method to have coverage for prescription medications is to sign up for a stand-alone prescription medication strategy called Medicare Component D. Also the inexpensive strategies generally use a good value for the protection you get. All plans have$0 copays for common drugs. Wellcare will certainly additionally ship your medicines to your home at no extra price to you. Wellcare Part D strategies have a high ordinary score on And also, Wellcare has one of the most preferred stand-alone Part D plan in the country. Blue Cross Blue Guard has an average of 3.5 out of 5 celebrities

Senior Insurance Advisor Santa Ana, CA

on, while UnitedHealthcare and Aetna both have 3 celebrities. BCBS is one of the biggest wellness insurance coverage companies in the country and has one of the largest networks of physicians and medical facilities. Numerous Blue Cross Blue Shield companies have advantages that exceed what a conventional health insurance supplies. This suggests you can customize your protection to your unique demands. Also though some plans only cover in-network treatment, UHC's big network of doctors provides you a lot more freedom concerning where you obtain healthcare while still remaining in the network. Medicaid is one of the most budget friendly prepare for senior citizens and retired people who have low revenues. Also if you already have Medicare, you can double register in both Medicaid and Medicare to decrease your clinical expenses. Earnings restrictions for Medicaid depend upon where you live. In 40 states and Washington, D.C., you can certify for Medicaid if you make. The limits are greater in Alaska and Hawaii. Elders aged 65 and over that earn excessive to get approved for Medicaid may still have the ability to qualify if they have high clinical expenses. The Medicaid spend down program allows you subtract your clinical costs from your income. You can utilize this decreased quantity toqualify for Medicaid. Medicare is the very best medical insurance for senior citizens and seniors. Variables such as cost, protection, benefits and networks of physicians were used to contrast firms. Other sources consist of: Medicare Benefit prices are just for plans that include prescription medicine advantages. The price evaluation omits employer-sponsored plans, Unique Needs Plans, PACE strategies, sanctioned plans and Health Treatment Prepayment Program( HCPPs). Medigap expenses are based upon information for all private companies, using quotes for a 65-year-old women nonsmoker. By calling a Specialist at you can obtain a complimentary comparison of your employer plan with your Medicare options.

Homeowners in Pennsylvania have the choice to enroll right into a Medicare Supplement Plan( Medigap), Prescription Medication Plan (Component D or PDP )or a Medicare Advantage Plan( Component C). Medicare Supplements are non-network-based plans, meaning you can see any type of doctor or expert that approves Medicare. As mentioned, they can be bought to accompany your Medicare Supplement Strategy or acquired alone to enhance your Original Medicare Parts A and B. Prescription Medicine Plans are not suggested to cover 100 %of your prescription price, yet to assist reduce your prices.

Affordable Medical Insurance For Seniors Santa Ana, CA

Medicare Supplement Plans are health and wellness insurance coverage plans that use standard benefits to work with Original Medicare( not with Medicare Advantage). These plans might cover exceptional deductibles, coinsurance, and copayments and may also cover wellness treatment prices that Medicare does not cover at all, like treatment received when traveling abroad. When you become eligible for Medicare, you might need to register in both Medicare Component A(Medical Facility Insurance Coverage)and Part B(Medical Insurance coverage)to get full benefits from your senior citizen insurance coverage.

If you pick not to sign up with a Medicare drug plan, you'll require to have reputable drug protection to stay clear of paying a Component D late enrollment fine. Reputable drug coverage is protection that provides the very same value as Medicare drug coverage. If you're not exactly sure your retiree medicine strategy is thought about reputable, ask your strategy they need to inform you. Get in touch with your benefits administrator prior to making any kind of decisions.Who gets Additional Assist? Given that Medicare pays first after you retire, your senior citizen coverage is possibly comparable to insurance coverage from a Medicare Supplement Insurance(Medigap)policy. Both are most likely to supply benefits that fill out several of the spaces in Medicare coveragelike coinsurance and deductibles. Medicare is the Federal health and wellness insurance policy program for individuals 65 years of age or older. You may additionally be eligible for Medicare prior to age 65 if you have a disability, End-Stage Renal Disease(ESRD), or ALS(Lou Gehrig's disease). (hospital insurance policy )covers in-patient treatment obtained at a healthcare facility, proficient nursing center, or hospice and some home healthcare. cover what Medicare Components A and B cover and some additional advantages like certain dental, vision, and hearing advantages. Medicare Advantage prepares accessed with FEHB offer medication coverage similar to Component D drug protection. * Extra registration alternatives are outlined

listed below. There are various methods to register in Medicare when you have FEHB. Your if it uses Medicare drug benefits and you're qualified for Component D. You are eligible for this benefit if you only have Medicare Component A or Part B or both Component A and Part B. You have the choice to opt-out by contacting your FEHB plan before protection begins. Disenrollment political elections are reliable the first day of the adhering to month. You have to have Component A and Part B to elect a Medicare Advantage plan accessed via FEHB. Use the plan comparison device to find a strategy. Contact the plan directly or adhere to the instructions in the plan pamphlet to register. If you don't get Social Security or RRB benefits, authorize up for Component A and Component B online at gov, by phone at 1-800-772-1213, or in-person at your regional SSA workplace.

Harmony SoCal Insurance Services

Address: 2135 N Pami Circle Orange, CA 92867Phone: (714) 922-0043

Email: [email protected]

Harmony SoCal Insurance Services

You should have Part A and/or Component B to elect a Component D plan. Utilize the Medicare Plan Finder to find a Component D medication strategy and sign up. Or call Medicare at 1-800-633-4227, TTY customers can call 1-877-486-2048. You should have Component A and Component B to choose a Medicare Advantage plan. A lot of Medicare Benefit plans deal medicine coverage. In that situation, you'll obtain medicine protection as part of your enrollment. Discover strategies and enroll by utilizing the Medicare Strategy Finder.

Santa Ana, CASanta Ana, CA

Santa Ana, CA

Near Me Seo Companies Near Me Santa Ana, CA

In Seo Company Near Me Santa Ana, CA

Medicare Part D Plans Near Me Santa Ana, CA

Harmony SoCal Insurance Services

Table of Contents

- – Senior Benefits Insurance Services Santa Ana, CA

- – Harmony SoCal Insurance Services

- – Senior Insurance Quotes Santa Ana, CA

- – Best Eye Insurance For Seniors Santa Ana, CA

- – Health Insurance Seniors Santa Ana, CA

- – Senior Insurance Advisor Santa Ana, CA

- – Affordable Medical Insurance For Seniors San...

- – Harmony SoCal Insurance Services

Latest Posts

Water Heater Repair Near Me Torrey Hills

Water Heater Repair Service Encinitas

Miramar Ranch North Bradford White Water Heater Repair

More

Latest Posts

Water Heater Repair Near Me Torrey Hills

Water Heater Repair Service Encinitas

Miramar Ranch North Bradford White Water Heater Repair