All Categories

Featured

Table of Contents

- – Senior Solutions Insurance Dana Point, CA

- – Harmony SoCal Insurance Services

- – Funeral Insurance For Seniors Dana Point, CA

- – Best Funeral Insurance For Seniors Dana Point, CA

- – Individual Health Insurance Plans Dana Point, CA

- – Term Insurance For Senior Citizens Dana Point...

- – Health Insurance For Retired Dana Point, CA

- – Senior Solutions Insurance Dana Point, CA

- – Senior Vision Insurance Dana Point, CA

- – Human Resources And Payroll Services Dana Po...

- – Best Health Insurance Plans For Self Employe...

- – Senior Vision Insurance Dana Point, CA

- – Harmony SoCal Insurance Services

Senior Solutions Insurance Dana Point, CA

Harmony SoCal Insurance Services

2135 N Pami Circle Orange, CA 92867(714) 922-0043

https://maps.google.com/maps?ll=33.823884,-117.830838&z=16&t=h&hl=en&gl=US&mapclient=embed&cid=276141583131225364

Interest will certainly be paid from the day of fatality to day of repayment. If fatality is because of natural reasons, death profits will certainly be the return of premium, and passion on the premium paid will go to an annual effective rate specified in the policy contract. This policy does not guarantee that its proceeds will be adequate to pay for any particular solution or goods at the time of requirement or that services or product will be given by any kind of certain supplier.

A full declaration of coverage is found only in the plan. For even more details on protection, costs, limitations; or to look for coverage, speak to a neighborhood State Farm representative. There are constraints and problems relating to settlement of benefits because of misstatements on the application. Rewards are a return of premium and are based upon the real death, expenditure, and financial investment experience of the Firm.

Funeral Insurance For Seniors Dana Point, CA

Long-term life insurance policy establishes cash money worth that can be borrowed. Plan fundings build up passion and unpaid plan car loans and passion will decrease the survivor benefit and cash money worth of the plan. The amount of cash worth readily available will usually depend on the type of long-term plan bought, the quantity of protection bought, the size of time the plan has actually been in pressure and any impressive policy lendings.

They are generally issued to applicants with one or more wellness problems or if the applicant is taking specific prescriptions. If the insured passes during this duration, the beneficiary will normally obtain all of the costs paid right into the plan plus a little additional percentage. Another last cost option supplied by some life insurance policy firms are 10-year or 20-year strategies that provide candidates the option of paying their plan completely within a particular amount of time.

The most essential point you can do is answer concerns honestly when obtaining end-of-life insurance coverage. Anything you keep or hide can trigger your benefit to be refuted when your family requires it most. Some individuals think that due to the fact that a lot of last cost plans don't require a clinical exam they can exist concerning their wellness and the insurance provider will never ever recognize.

Share your final dreams with them also (what flowers you might want, what flows you want checked out, songs you desire played, etc). Recording these ahead of time will save your loved ones a great deal of anxiety and will stop them from attempting to presume what you wanted. Funeral costs are rising regularly and your health might alter instantly as you grow older.

Best Funeral Insurance For Seniors Dana Point, CA

The key beneficiary obtains 100% of the death advantage when the insured dies. If the main beneficiary passes before the guaranteed, the contingent obtains the advantage.

Constantly notify your life insurance firm of any change of address or phone number so they can update their documents. Lots of states permit you to pre-pay for your funeral.

The fatality benefit is paid to the primary beneficiary once the insurance claim is accepted. It depends upon the insurance company. Most individuals can get coverage till they transform 85. There are some companies that insure a person over the age of 85, however be prepared to pay a very high costs.

Individual Health Insurance Plans Dana Point, CA

If you do any type of kind of funeral preparation beforehand, you can record your final long for your main recipient and show how much of the plan advantage you want to go towards final plans. The process is usually the same at every age. A lot of insurer require an individual go to the very least 1 month old to request life insurance coverage.

Some companies can take weeks or months to pay the plan advantage. Others, like Lincoln Heritage, pay approved cases in 24 hr. Senior Citizens Insurance Dana Point. It's difficult to say what the average premium will be. Your insurance coverage rate depends upon your health, age, sex, and just how much insurance coverage you're getting. A good quote is anywhere from $40-$60 a month for a $5,000 $10,000 policy.

Tobacco prices are greater no matter what sort of life insurance policy you secure. The older you are, the greater your cigarette price will certainly be. Final cost insurance coverage raises a monetary concern from family members grieving the loss of a person they like. If you desire to give those you appreciate a safeguard throughout their time of grief, this policy type is a terrific alternative.

Term Insurance For Senior Citizens Dana Point, CA

Our web content is based solely on unbiased study and data event. We keep strict editorial self-reliance to make sure objective coverage of the insurance policy sector. Nobody likes to think of their funeral service or memorial solution, but intending ahead is a sensible decision that safeguards your family's financial wellness when they are regreting a loss.

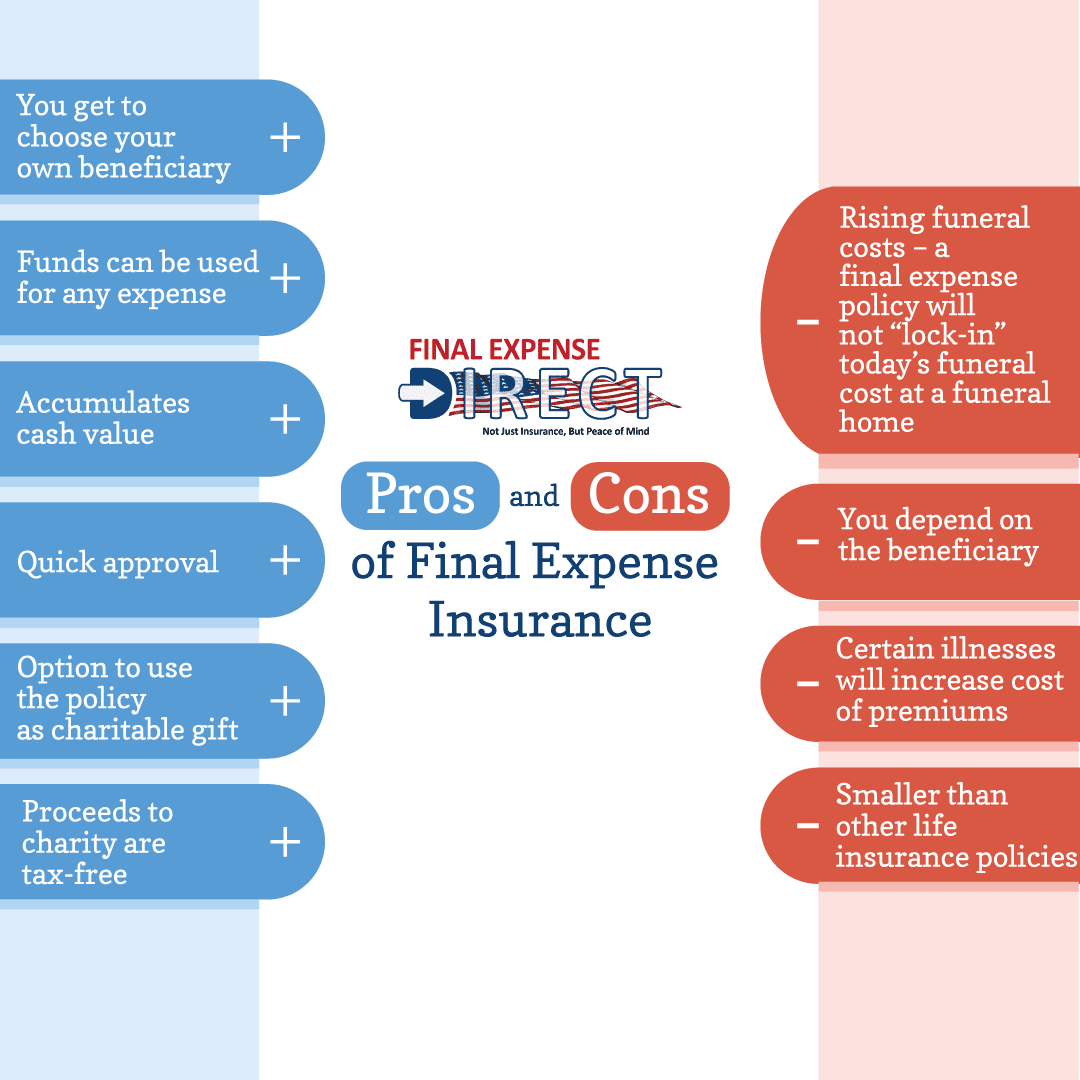

The death benefit from last expense insurance can be utilized to spend for end-of-life expenses, such as final medical expenses or funeral costs. Burial insurance coverage is best for seniors or people with significant wellness conditions that restrict them from obtaining traditional life insurance coverage. Standard term life insurance policy is extra affordable and supplies higher insurance coverage quantities than final expenditure insurance policy.

Health Insurance For Retired Dana Point, CA

Unlike typical life insurance policy policies, last expense insurance typically does not require a clinical examination, which makes it obtainable to individuals who might have pre-existing health and wellness conditions. Instead, candidates normally respond to a few health-related concerns throughout the application process. The costs continue to be level throughout the life of the policy, indicating they won't raise as you age, supplying assurance for elders on a set income.

While several life insurance business use these policies, in particular states, funeral homes might likewise sell them. Funeral expenses vary widely, however the ordinary funeral price can set you back thousands.

Like all kinds of life insurance policy, final expenditure insurance policy premiums tend to increase with age. The older you are when you purchase a plan, the more you'll have to pay over the lifetime of the plan. The graph below displays ordinary yearly premiums for men and females age 45 to 65.

Senior Solutions Insurance Dana Point, CA

You can pre-pay for your funeral with a funeral home, however if the funeral home goes out of service in the future, you'll lose that cash. You can put money into a depend on that your beneficiaries would certainly utilize for your end-of-life costs.

Fully underwritten life insurance policy can offer more for less. These plans use a knockout concern system: Identified with AIDS? Male, age 65 $25,000 graded benefit last expense plan.

Senior Vision Insurance Dana Point, CA

And if you have actually been told that your health problem would only permit a graded plan, don't believe it! The above prices are available for individuals with wellness problems like cardiovascular disease, a background of cancer cells, diabetes, liver disease, and HIV+. No wellness concerns, no clinical examination, and everyone gets approved yet with a 2-year waiting duration.

The death benefit will certainly differ based on a couple of elements. Of training course, is the quantity of insurance coverage you choose ona $10,000 policy will certainly set you back much less than a $30,000 policy, and so on. It is likewise figured out by your wellness, the insurance company, and what they provide, in addition to your age.

The typical funeral service with interment expenses about $8,000. Without something to cover these costs, your liked ones might have a very hard time managing the necessary costs. With final expense, you ease this problem.

Human Resources And Payroll Services Dana Point, CA

Understanding that life insurance coverage aids cover expenses should not be as well unexpected. Maybe you waited as well long, and now are also old to be eligible for a policy.

There are two sorts of last expense plansstreamlined concern and ensured issue. With streamlined concern, all you need to do is answer a simple set of questions regarding your health and wellness. You will qualify as long as long as you have no lethal conditions. With assured concern, you'll have ensured authorization. Most of all, you can live comfortably understanding that you have the insurance coverage you and your enjoyed ones require (Senior Citizens Insurance Dana Point).

Best Health Insurance Plans For Self Employed Dana Point, CA

Secure Insurance coverage Group desires to make your insurance coverage as straightforward as possible. Call us today or e-mail to find out more.

Final cost insurance policy is a kind of life insurance coverage that helps elders If you don't have a final cost life insurance policy strategy in location for these expenses, your loved ones will certainly be liable for them by default. Funeral prices are expensive, and there are probably more costs than you recognized.

Be advised, nevertheless, that many firms permit you buy a plan with a very tiny advantage. For example, $3,000 is the minimal advantage quantity with one of the providers we represent. Be careful that you do not ignore your last expense costs. A $3,000 plan is not virtually sufficient to cover the many standard of funeral services.

There's no one-size-fits-all answerbecause every person's end-of-life dreams and monetary circumstances are various. At The Paul Team, we'll collaborate with you individually to figure out just how much coverage you require. Some people intend to cover a small cremation solution, while others favor to prepare for a complete typical funeral and funeral. Much of our clients also consist of a cushion for clinical prices, accounts payable, or legacy gifts for loved ones.

Senior Vision Insurance Dana Point, CA

Numerous of our clients obtain authorized the very same day they apply. If you've been transformed down permanently insurance policy in the past, this can be the solution you have actually been looking for. No person suches as thinking of completion of lifebut preparation in advance is among the most thoughtful presents you can offer your household.

As you age, your demands for life insurance modification.

Elders might be considering end-of-life arrangements so they don't move that concern to their enjoyed ones they leave. Usually, by this time in your life, your children are grown and you're preparing yourself to take pleasure in retired life (Senior Citizens Insurance Dana Point). No matter how old you are, it's never ever far too late to take into consideration life insurance coverage

Harmony SoCal Insurance Services

Address: 2135 N Pami Circle Orange, CA 92867Phone: (714) 922-0043

Email: [email protected]

Harmony SoCal Insurance Services

If you are still working, you may wish to decide in to a team strategy, and if you're not, see to it you get a variety of quotes and contrast prices. One firm may see you as even more of a threat contrasted to another. Budget friendly life insurance policy for elders is feasible with a little research study.

Individual Health Insurance Plans Dana Point, CAVision Insurance For Seniors On Medicare Dana Point, CA

Best Dental Insurance For Seniors On Medicare Dana Point, CA

Near Here Seo Package Dana Point, CA

Finding A Good Local Seo Service Dana Point, CA

Senior Citizens Insurance Dana Point, CA

Harmony SoCal Insurance Services

Table of Contents

- – Senior Solutions Insurance Dana Point, CA

- – Harmony SoCal Insurance Services

- – Funeral Insurance For Seniors Dana Point, CA

- – Best Funeral Insurance For Seniors Dana Point, CA

- – Individual Health Insurance Plans Dana Point, CA

- – Term Insurance For Senior Citizens Dana Point...

- – Health Insurance For Retired Dana Point, CA

- – Senior Solutions Insurance Dana Point, CA

- – Senior Vision Insurance Dana Point, CA

- – Human Resources And Payroll Services Dana Po...

- – Best Health Insurance Plans For Self Employe...

- – Senior Vision Insurance Dana Point, CA

- – Harmony SoCal Insurance Services

Latest Posts

On Demand Water Heater Sorrento Valley San Diego

Poway Plumber Repair

Slab Leak Plumber Mira Mesa

More

Latest Posts

On Demand Water Heater Sorrento Valley San Diego

Poway Plumber Repair

Slab Leak Plumber Mira Mesa