All Categories

Featured

Table of Contents

- – Employee Benefits Outsourcing Companies Westmin...

- – Harmony SoCal Insurance Services

- – Payroll Services Westminster, CA

- – Payroll Services For Small Businesses Westmins...

- – Best Payroll Services For Small Businesses We...

- – Best Payroll Services For Small Businesses We...

- – Employee Benefits Outsourcing Companies West...

- – Local Payroll Services Westminster, CA

- – Employee Benefits Consulting Firms Westminst...

- – Employee Benefits Company Westminster, CA

- – Employee Benefits Consultants Westminster, CA

- – Employee Benefits Company Westminster, CA

- – Payroll Services For Small Business Westmins...

- – Payroll Services Small Business Westminster, CA

- – Payroll Service Providers Westminster, CA

- – Harmony SoCal Insurance Services

Employee Benefits Outsourcing Companies Westminster, CA

Harmony SoCal Insurance Services

2135 N Pami Circle Orange, CA 92867(714) 922-0043

https://maps.google.com/maps?ll=33.823884,-117.830838&z=16&t=h&hl=en&gl=US&mapclient=embed&cid=276141583131225364

Tax obligation planning is among the most difficult elements of pay-roll. Also the smallest conformity mistakes can have high consequences. That's why our team of professionals is right here to aid you adhere to government policies from starting to end, starting with the W-2s and 1099s. We can handle your tax deductions weekly, your tax obligation payments on a quarterly or annual basis, and your staff members' year-end revenue tax obligation paperwork.

Several of our customers favor to take a hands-off technique to pay-roll and let the professionals handle it. For them, we provide complete pay-roll contracting out consisting of conventional or on the internet payroll entrance, time off and benefit monitoring, retirement preparation, risk mitigation, licensed pay-rolls, and quick client support. When you or your team have a concern, a local business payroll company will be there to answer it.

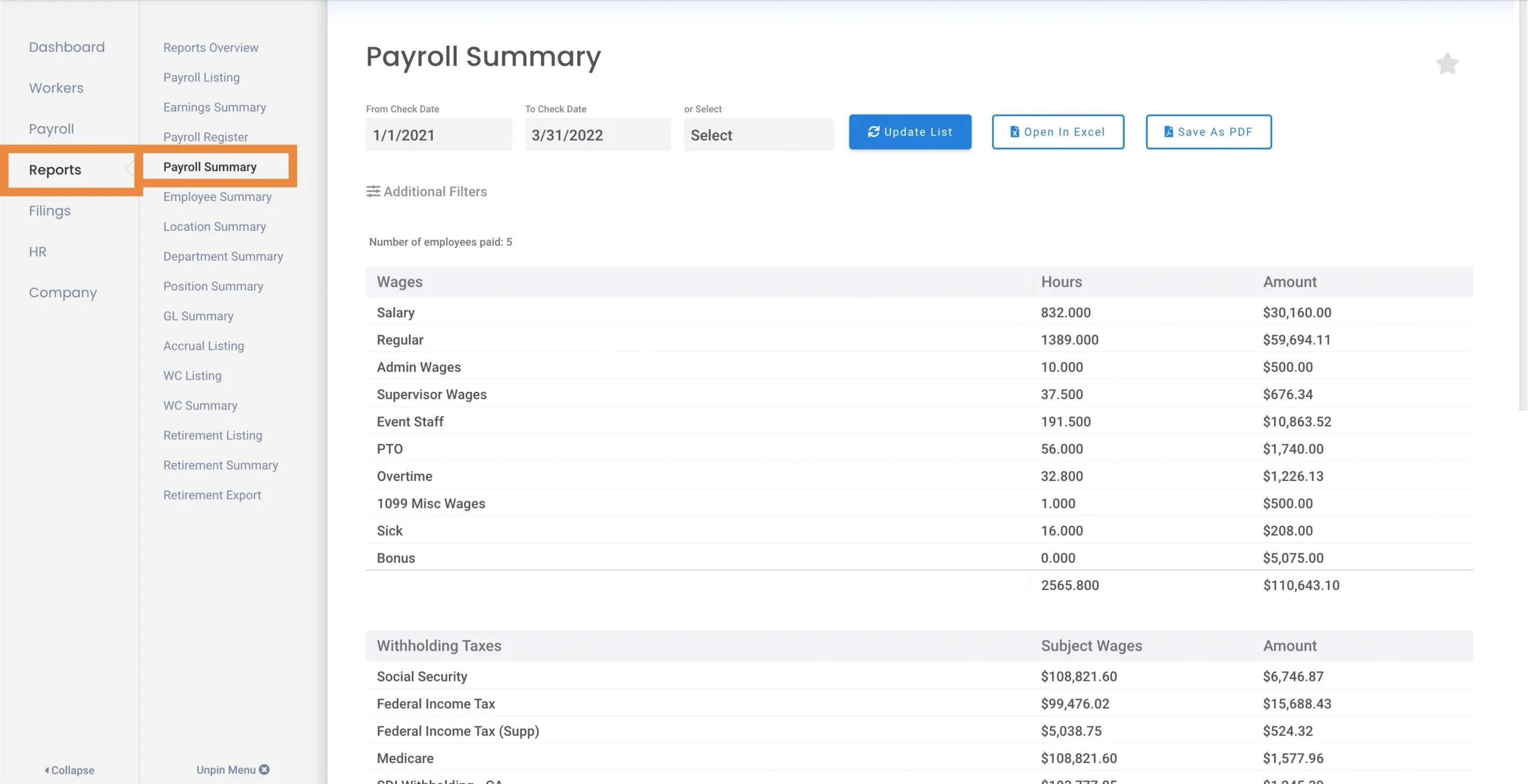

This software also features easy-to-follow layouts that are certain to conserve you time. Need to have a look at your pay-roll prices? New employ reports? We make it simple and fast by providing exact coverage you can access with just a few clicks. We supply an easy, user-friendly worker self-service (ESS) website for payroll processes.

Payroll Services Westminster, CA

We recognize that "painless" will look various for every single company, which is why we don't press cookie-cutter options. Rather, we start by asking you the tough inquiries regarding your pay-roll. We'll locate out what jobs, what doesn't, what takes as well long, and where your most significant price is coming from. After that, we'll create a tailored bundle based on your requirements.

We can supply solutions and address any kind of inquiries you have. If your brand-new payroll business simply isn't meeting assumptions, we can aid you discover a new one. The quicker you let us know what isn't helping you, the faster we can leap in and make things right.

Payroll Services For Small Businesses Westminster, CA

There's a straightforward method to understand whether a worker is doing an excellent job: evaluate them. We wish to be your top staff member. We ask every customer to quality us on our efficiency, and we will not rest up until those scores are as high as feasible. This is why NetPEO has a rising client retention price and among the best credibilities for solution in business.

Right here are a few of the sectors that profit from our expert local business payroll solutions in Denver: Medical Care Legal Finance Program and entertainment Construction Realty Design Retail Farming Modern Technology Automotive Paying your small company pay-roll business is easy and budget friendly. When you partner with a payroll company in Denver, you'll have two settlement alternatives to pick from.

Best Payroll Services For Small Businesses Westminster, CA

If you select this settlement method, you can anticipate to pay between 3% and 10% of your general pay-roll. The second choice is to pay per employee, per year. If you choose this settlement method, you'll likely wind up paying $900 and $1,500 for each employee. This method is preferred amongst local business since it often tends to maintain expenses extra foreseeable.

If you have actually ever before dealt with tax errors, missed filings, or shed hours to manual data entry, you understand that running payroll can obtain messyfast. That's where the right payroll firm can make all the distinction.

So what in fact sets the ideal pay-roll business aside from the rest? Below's what to look for: Trust matters. Seek pay-roll companies with solid reviews, proven track records, and experience collaborating with companies like yours. The very best pay-roll service for small company is one you can really reach. Whether it's online chat, phone support, or a dedicated associate, you want quick solutions when pay-roll concerns show up.

, and straight deposits so you can run payroll with self-confidence. The ideal pay-roll supplier should take that weight off your shoulders by staying on top of compliance for you.

Best Payroll Services For Small Businesses Westminster, CA

To choose the best pay-roll business for your tiny businesses, you require to choose the one that best fits your group, industry, and daily procedures. Right here's just how 10 top payroll business accumulate across price, features, and company needs in 2025. Best For: Local business needing payroll + HR + benefits in one placeKey Attributes: Automated payroll, tax obligation declaring, employee benefits, onboarding toolsStarting Price: $40/month + $6 per employeeFree Trial? YesGusto is just one of the leading payroll services for local business, with a clean user interface and solid human resources functions.

Square payroll makes the many sense for businesses already utilizing Square POS. Best For: Budget-conscious businesses and nonprofitsKey Functions: Full-service payroll, tax filings, benefits, and HR toolsStarting Rate: $40/month + $6 per employeeFree Trial?

Best For: Extremely little teams and startups with simple pay-roll needsKey Attributes: Basic pay-roll, direct down payment, tax declaring (full-service choice available)Beginning Price: $17/month + $4 per employee (standard); $37/month + $4 for full-serviceFree Test? YesIf price is your largest concern, Patriot Pay-roll is a great budget-friendly payroll solution option. While it's not loaded with extras, it covers the fundamentals well and is simple to find out.

For small organizations looking for cloud-based remedies, Gusto, Homebase Payroll, and QuickBooks Pay-roll are top choices. These on the internet pay-roll services use automated tax obligation filing, simple onboarding, and integrations with devices you might already uselike scheduling and audit software application.

Employee Benefits Outsourcing Companies Westminster, CA

This contract launches on a worker's hire date. It additionally considers any kind of quality raises, bonuses, or any other contingencies impacting the base rate. For someone who is not as affluent in pay-roll tax regulations and ordinances, it can be an overwhelming job. Pay-roll has its own collection of guidelines and caveats that make it extra difficult.

Each brand-new hire is needed to load out a W-4 or W-9 throughout worker onboarding. Employees choose on these forms how much they intend to pay in taxes to meet their taxed worry.

Local Payroll Services Westminster, CA

The United State Irs (INTERNAL REVENUE SERVICE) then measures up the yearly earnings to the worker's income tax obligation bracket to guarantee the tax obligation was satisfied. If workers underpaid their tax obligation burden for the previous schedule year, they will certainly owe tax obligations. This might result in wage garnishment, which becomes one more task for the human resources department.

In lots of cases, a tiny business might not have a specialized HR supervisor or department. The threat of high turn over or being audited as an organization exponentially grows when leadership struggles with pay-roll and conformity. The pay-roll solutions market targets Human resources divisions of tiny and moderate organizations up to large firms.

Employee Benefits Consulting Firms Westminster, CA

Pay-roll SAAS options have actually experienced fast growth in the previous years. The worldwide HR and payroll solutions and software market was once valued at $17.2 billion (U.S.) in 2016. This figure is expected to swell to $41.6 billion (UNITED STATE) by 2026. This development came about when little companies and business started welcoming assistance running their companies in the audit and HR divisions.

Several small companies pay weekly, bi-weekly (every 2 weeks), semi-monthly (two times a month on a set day), or monthly. A crucial for worker spirits is established expectations for when they'll obtain the cash they have actually striven for. The W-4 type is essential for keeping the proper federal revenue tax from your worker pay.

ADP and Paychex are no question amongst one of the most well-known names in the payroll market. Many various other human resources remedies companies help with greater than payroll configuration and continuous upkeep. Zenefits, Quickbooks, and Paytech are amongst the climbing names in the company. It's becoming extra usual that tiny companies contract out payroll tasks.

To finish pay-roll features, today's software application uses the finest of man-made intelligence and autonomy for effectiveness and precision. A payroll solution supplier can assist make sure proper record keeping for a service' labor force.

Employee Benefits Company Westminster, CA

Other essential factors are safety and security attributes and compatibility with time administration and audit devices. You recognize your company best and can assess when relying on outside person or device is the best action for you. A leading advantage to working with a pay-roll services supplier, like PayTech, is having a devoted account supervisor.

It's crucial to comprehend that it is difficult to have a one-size expense blanket for pay-roll services. Every organization has different requirements from a pay-roll service supplier.

Other payroll firms for small companies have different rates rates and undergo various other backups that vary. Payroll can be simplified by outsourcing human resources jobs. Several are eliminated when using a pay-roll program that autonomously runs and accumulates the information necessary to run. Using ESS modules helps pare down the amount of paper that is essential.

Employee Benefits Consultants Westminster, CA

And, obviously, paper versions are still readily available by download whenever required. When a small company buys payroll software and finishes the setup, the procedures come to be quicker and much more effective. The software program pays for itself as time progresses. The time financial savings alone is a big benefit. Some programs even signal mistake warnings that can be corrected prior to paycheck circulation.

Companies prosper off of payroll. Take benefit of the most recent modern technology readily available with Paytech's payroll options for small organizations.

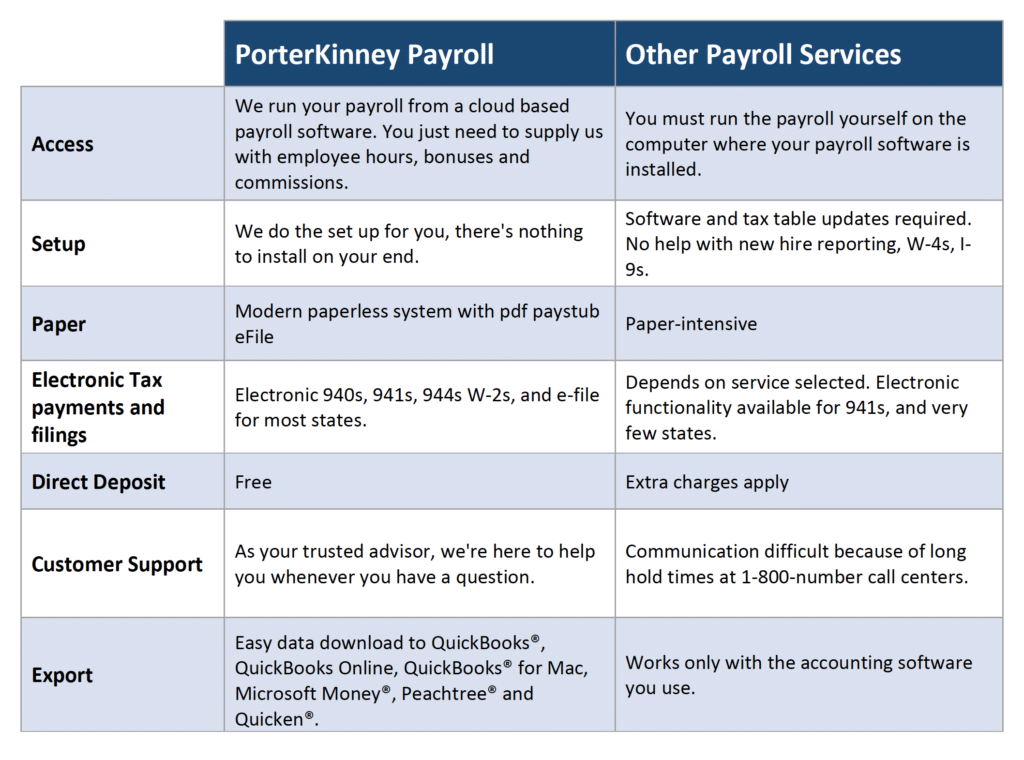

A wise individual as soon as stated, "Outsource your payroll." We don't understand who exactly that smart person was, yet right here at FA Bean Counters, our team believe that using a pay-roll service is an extremely wise move. Payroll solutions are incredibly preferred with today's local business owner, and forever reason. They make the payroll process effective and very easy.

Other crucial factors are safety and security functions and compatibility with time management and accounting devices. You recognize your business best and can examine when relying on outdoors person or tool is the best step for you. A leading advantage to dealing with a payroll services provider, like PayTech, is having a specialized account supervisor.

Employee Benefits Company Westminster, CA

It's vital to understand that it is difficult to have a one-size cost blanket for payroll solutions. Every organization has various requirements from a pay-roll solution carrier.

Other pay-roll companies for local business have various rates rates and undergo various other backups that differ. Pay-roll can be simplified by outsourcing HR tasks. Lots of are eased when using a payroll program that autonomously runs and gathers the information required to operate. Making use of ESS modules assists curtail the amount of paper that is required.

When a little organization spends in pay-roll software application and finishes the arrangement, the processes come to be quicker and more efficient. The software pays for itself as time advances.

Payroll Services For Small Business Westminster, CA

Paytech offers this starting at $51 each month, and it is consisted of in the same package with direct down payment above. Other business have various prices bundles based on workforce dimension, the modern technology required, and more. Businesses thrive off of pay-roll. Without it, services would collapse. Make the most of the most up to date modern technology offered with Paytech's pay-roll options for small companies.

A smart person as soon as said, "Outsource your pay-roll." We don't know who exactly that wise person was, however below at FA Bean Counters, our company believe that utilizing a payroll solution is a really smart step. Pay-roll solutions are extremely prominent with today's company owners, and permanently reason. They make the pay-roll procedure reliable and easy.

Various other important points are protection attributes and compatibility with time management and accounting tools. You recognize your company best and can evaluate when trusting outdoors individual or device is the ideal action for you. A leading benefit to functioning with a pay-roll services supplier, like PayTech, is having a devoted account manager.

It's essential to recognize that it is difficult to have a one-size expense blanket for pay-roll services. Every service has various requirements from a payroll solution supplier.

Payroll Services Small Business Westminster, CA

Various other payroll companies for tiny organizations have various prices rates and undergo various other backups that differ. Pay-roll can be made less complicated by outsourcing human resources jobs. Several are soothed when using a pay-roll program that autonomously runs and gathers the data needed to run. Using ESS components helps curtail the quantity of paper that is needed.

When a small business spends in payroll software program and completes the setup, the procedures become quicker and more efficient. The software application pays for itself as time advances.

Payroll Service Providers Westminster, CA

Paytech provides this starting at $51 per month, and it is included in the exact same bundle with straight down payment above. Other companies have different rates plans based upon labor force dimension, the modern technology needed, and extra. Organizations prosper off of payroll. Without it, organizations would certainly collapse. Capitalize on the newest innovation offered with Paytech's payroll choices for local business.

Harmony SoCal Insurance Services

Address: 2135 N Pami Circle Orange, CA 92867Phone: (714) 922-0043

Email: [email protected]

Harmony SoCal Insurance Services

A smart individual when stated, "Outsource your payroll." We don't know that specifically that sensible individual was, however here at FA Bean Counters, we believe that using a pay-roll service is a very wise step. Pay-roll solutions are unbelievably popular with today's company proprietors, and forever factor. They make the pay-roll procedure efficient and simple.

Employee Benefits Consulting Firms [:city], [:state]Payroll And Services [:city], [:state]

Employee Benefits Brokerage Firms [:city], [:state]

Affordable Seo Package [:city], [:state]

Near My Location Seo Services [:city], [:state]

Harmony SoCal Insurance Services

Table of Contents

- – Employee Benefits Outsourcing Companies Westmin...

- – Harmony SoCal Insurance Services

- – Payroll Services Westminster, CA

- – Payroll Services For Small Businesses Westmins...

- – Best Payroll Services For Small Businesses We...

- – Best Payroll Services For Small Businesses We...

- – Employee Benefits Outsourcing Companies West...

- – Local Payroll Services Westminster, CA

- – Employee Benefits Consulting Firms Westminst...

- – Employee Benefits Company Westminster, CA

- – Employee Benefits Consultants Westminster, CA

- – Employee Benefits Company Westminster, CA

- – Payroll Services For Small Business Westmins...

- – Payroll Services Small Business Westminster, CA

- – Payroll Service Providers Westminster, CA

- – Harmony SoCal Insurance Services

Latest Posts

Wedding Photographer Package Tustin

Find A Wedding Photographer Corona

Orange County Hire Wedding Photographer

More

Latest Posts

Wedding Photographer Package Tustin

Find A Wedding Photographer Corona

Orange County Hire Wedding Photographer